All content provided in this blog is only for informative purposes and is not meant to be taken as advice in any form. Please consult your medical professional or lawyer before making a final decision.

Aesthetic medicine has come leaps and bounds over the last decade. However, that doesn’t mean aesthetic treatments administered by cosmetologists are perfect and devoid of undesirable effects. Any treatment that involves injections and resurfacing has an element of risk associated with it. The best way to mitigate legal risks as a practitioner of aesthetic medicine is to get yourself insurance to cover surgical liabilities.

So why do you need aesthetic insurance? If a claim is made for any insured treatments you give patients or advice you give them, medical malpractice insurance will shield you from any potential costs and damages you could be required to pay by law.

What Is the Best Aesthetician Insurance One Can Get?

In order to get the best aesthetician insurance available on the market, you will need to first identify your coverage requirements and then find the policies that offer those specific coverages.

If you aren’t 100% sure which coverages you would require in your line of treatments, then it’s recommended to opt for general liability insurance that covers a whole array of legal claims made against you. Here are some coverages that the best insurance policies include:

- Medical Malpractice Insurance

- Employers Liability Cover

- General Liability Insurance

- Public Liability Coverage

- Contents and Stock Cover

Additionally, try to find insurance policies that cover specific treatments, beauty products, confidentiality breaches, reputational harm, business interruption, accidental damages, etc. Also, it’s important to remember that a cheaper and more economical premium doesn’t always mean better coverage.

It takes prudent perusal of insurance policies offered by various firms to find the perfect balance between cost and risk coverage. It’s advised that aestheticians take the time to even get an expert legal opinion before opting for an insurance plan. Standard Limits of Indemnity range from $2.25 to $5.65 million, but certain procedures may be offered more.

Treatments That Are Typically Covered by an Aesthetician Insurance

- Laser treatments such as acne laser therapy, phytotherapy, radon therapy, laser hair, and skin therapy

- Hair transplants

- Spa treatments such as waxing, paraffin baths, cosmetic makeup, hydrotherapy, inhalation therapy, bubble baths, enzyme baths, mud bath, and steam bath

- Fat transfer surgeries

- Ayurvedic treatments, herbal treatments, and detoxification procedures

- Facial injection and rejuvenation treatments

- Body piercing, Botox injections, and injectable neurotoxins

- Chemical peels and cell therapy

- Dermal filler treatments, lipolysis, mesotherapy, and silicone injections

- Eyebrows, exfoliation, dermaplaning, and electrolytic therapy

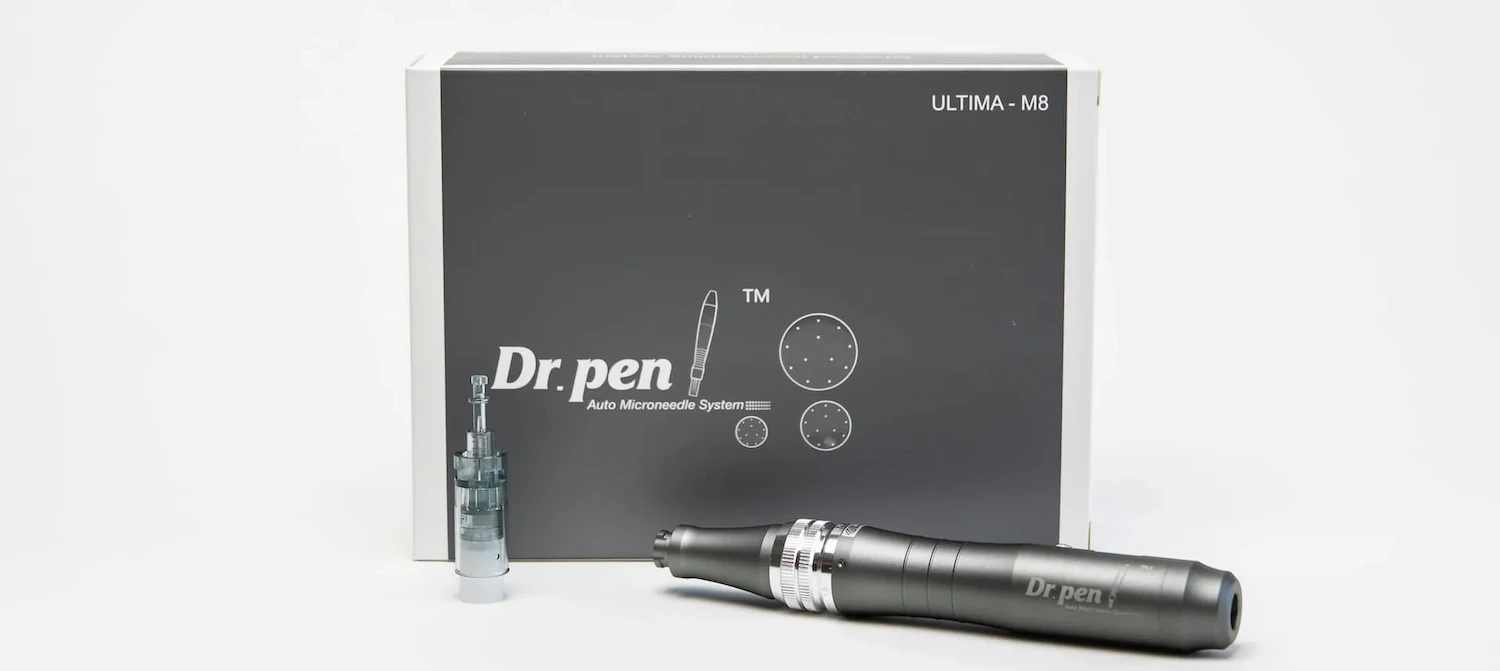

- Microneedling, micropigmentation, and laser frequency ultrasound therapy

- Tattoo removal and lightening services

- Body contouring and microblading procedures

Why Do You Need Aesthetician Insurance?

1) Covers legal expenses arising from medical malpractice

Without sufficient insurance, you will be forced to personally defend yourself against any accusations, which may be quite expensive. If you‘re found to be at fault, the cost of compensatory damages alone — before factoring in lost wages and other expenses—can reach hundreds of thousands of dollars.

2) Covers mobile clinics and self-employed practitioners

Most insurance policies protect you against accidental damages that may have occurred due to tripping, slipping, or falling within the area of the clinic. This is especially beneficial for clinics that are mobile (perform procedures in different locations) and for self-employed practitioners. working in and out of different clinic locations or in patients’ homes.

3) Covers claims against beauty treatments

It’s common for medical spas to sell and recommend beauty/skincare products to their customers. In such cases, it’s important to have aesthetician insurance that can cover the costs incurred due to failed treatments or procedures.

4) Shows that you meet professional standards

Having the appropriate insurance in place not only protects practitioners but also assures clients that you uphold the highest levels of professionalism. This is because most insurance providers only offer their policies to professionals who have undergone training in the procedure they’re performing on patients.

What Kind of Insurance Does an Aesthetician Need?

Cosmetic liability insurance should be your top priority if you’re a purveyor of skincare treatment and procedures. Even if you’re a seasoned veteran, getting aesthetician insurance will give you the safety net that will protect you from overwhelming legal costs.

Having aesthetics insurance ensures that your assets are safeguarded in the event that a claim is made against you. An expert insurance provider will also continuously offer help and direction, giving you peace of mind.

Enough coverage also demonstrates care for patients and may be required by some professional and regulatory authorities. In general, there are two sets of standard policy covers that come with most aesthetician liability covers. They are:

- Medical Malpractice: This policy provides protection from accusations of carelessness leading to an injury brought on by beauty treatments, such as hair transplants, laser treatments, invasive laser lipolysis, dermal fillers, and injections of botulinum toxin.

- Professional Indemnity: Professional indemnity insurance for aesthetic physicians is a type of liability insurance that protects against specific risks, such as careless misdiagnosis, inappropriate medication dosage, improper surgery, and the wrong course of treatment.

Who Is Eligible for Acquiring Aesthetician Insurance?

Liability coverage and insurance policies can be availed by different people in the aesthetics industry. This includes medics, non-medics, nurses, and practitioners. There are also a number of policies designed for specific types of practitioners. Professions eligible to apply for aesthetician insurance include:

- Paramedics & Emergency Medical Technicians

- Dental Nurses

- Dentists

- Nurse Prescribers

- Operating Department Practitioners

- Aesthetic & Cosmetic Nurses

- Doctors & Surgeons

- Pharmacists

- Midwives

Do I Need Training for Availing an Aesthetician Policy?

If you have received training for specific treatments (for example, anti-wrinkle injectable therapies) and are a medically qualified professional, such as a nurse, paramedic, doctor, dentist, or pharmacist, most insurance providers will offer you the claimed coverage right away.

Meanwhile, your case will be evaluated along with your insurance application if you’re a non-medical professional with experience in the beauty business. The amount of training necessary to perform the treatments will be compared with your experience in the field. Generally speaking, the minimal requirement in addition to the necessary training is an NVQ Level 3 Beauty Qualification (or equivalent).

How Much Is Aesthetician Insurance?

An aesthetician insurance policy can vary in cost largely depending on the treatments you are offering, the size of your clinic, the type of policy you are opting for, and the insurance provider you choose. In general, the premium cost for aesthetician insurance can be categorized into 3 distinct groups:

- Basic: This is a group of general liability (GL) policies that offer coverage only for the essential services that are provided to the client and cost about $39 per month.

- Standard: This is a group of business owners’ policies (BOP) that covers equipment and building costs associated with an aesthetician operating from an official clinic. It costs about $49 per month for general liability and property coverage.

- Pro: This is a group of professional liability policies that offer protection against service errors. It costs about $99 per month for a business owner’s policy (BOP) and professional liability coverage.

How Much Is Malpractice Insurance for Aestheticians?

A malpractice insurance for aestheticians usually comes under the professional liability category of aesthetic insurance. With that being said, each policy has a different cost depending on a number of variables and factors that have to be taken into account. On average, it can cost you anywhere between $42 to $67 dollars for minimum coverage.

How to Get Insurance as an Aesthetician

Step 1: Make a List of Your Legal Coverage Requirements

We advise having an indemnity limit that will cover your worst-case scenario when purchasing medical malpractice or professional indemnity insurance. All awards for claims and defense expenses must be covered under the 12-month aggregate maximum limit specified in your policy.

Certain companies may only provide coverage for injectable procedures with a minimum limit of $1 million. You will be extremely vulnerable to treatment risk claims if you fall short of this level. You should consider the dangers involved with the treatments being used when determining your upper limit. For instance, working with models or famous people may carry a larger risk because claims for lost wages can be significantly higher.

Step 2: Match Your List With Policies Offered by Insurance Providers

Your next step is to shortlist insurance providers who offer policies that are in alignment with your budget and requirements. Ideally, you should be looking for insurance providers who offer the following coverages:

- License Protection: You may have to defend your profession and license if a complaint is made against you to the appropriate licensing organization. You will be compensated by a top-notch insurance policy for your legal counsel resulting from a covered license protection incident up to a total of $25,000 in reimbursement.

- Professional Liability: Usually covers the financial obligations you may incur as a result of a professional liability claim resulting from a covered medical incident up to $1,000,000 per claim / $3,000,000 annually in total.

- Defendant Expense Benefit: When you are obliged to attend a hearing, trial, or legal proceeding as a defendant in a covered claim, your aesthetician insurance policy will reimburse you up to $1,000 per day or $25,000 annually for lost wages and other covered expenses incurred.

- Defense Costs: Regardless of whether a favorable outcome is obtained, your personal professional liability insurance pays defense costs for covered claims. Costs associated with examining claims are also included in high-coverage policies. These defense expenses are covered in addition to the standard liability limits.

- Medical Payments: Medical payments for those who were affected by the incident are also covered by certain insurance policies. Reimbursement of essential medical costs for third parties who were hurt on your property or while visiting your place of business as a result of a covered occurrence that wasn’t a medical emergency is up to $25,000 per person / $100,000 annually in total.

- Information Privacy Fines and Penalties: Sometimes you may need an insurance policy to cover the fines and penalties associated with a breach of patient confidentiality that may have resulted from a leak or cyberattack.

- Reputational Damages: Reputational damage caused by the incident is also covered by insurance policies for aestheticians. For certain fees, such as those of outside legal or public relations experts, coverage is offered up to a total of $25,000 annually to address negative press or media attention, including the drafting of statements, press releases, and interviews resulting from your professional services.

- Deposition Representation: An aesthetician insurance policy provides deposition representation if you get a subpoena for records or testimony relating to professional services in a case in which you’re not named. The cost of hiring an attorney chosen by the insurer to help you get ready for a deposition is also covered by some policies.

- Personal Injury and First Aid: Insurance protection is also offered against claims of privacy invasion, libel, slander, and other alleged personal injuries made while you were doing your professional duties. With this insurance, you can get up to $10,000 in total annual reimbursement for the costs associated with giving first aid to others.

Step 3: Choose an Insurance Provider

After careful consideration of all the above policy coverages offered by the insurance providers, you need to make a decision on which policy gives you the most value for your money. Getting an expert legal opinion and asking other professionals who work in the beauty industry is highly recommended before committing to a policy.

Get Access to High-Quality Beauty Products and Training Courses at FACE Med Store

It’s important to have access to high-quality equipment and to have undergone extensive training to minimize the risk of damage to your client. Remember that if you minimize the number of claims made through your insurance policy, there’s a chance for a reduction in your premium costs.

At FACE Med Store, we provide a range of online training courses and beauty supplies and tools. These include training programs in the use of injectable therapy, cosmetic threading, dermal fillers, fractional radiofrequency treatment, and intense pulsed light (IPL), among others. To learn more about our cosmetic dermatology training programs, get in touch with us right away.